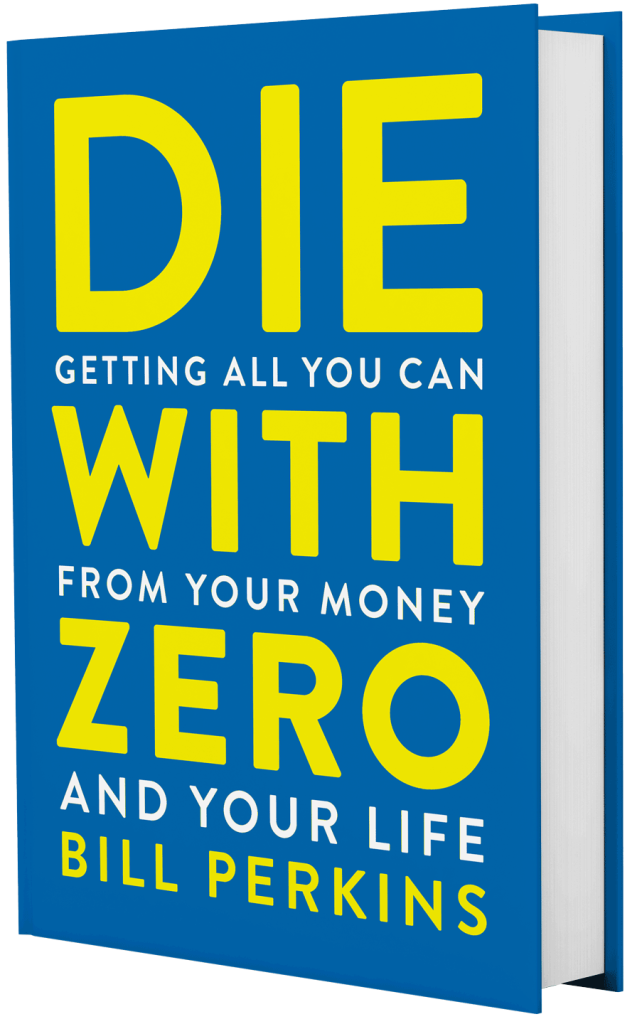

Rating: 10/10

Intro to Die With Zero

This is my book summary of Die With Zero by Bill Perkins. My notes are not formal and contain quotes from the book as well as my own rewording of the ideas.

“This book is not about making your money grow — it’s about making your life grow.”

500 Word Summary of Die with Zero

You have one life to live. Maximize for net fulfillment, not net worth.

We’ve become habituated to the hamster wheel of money accumulation. We’re on autopilot.

That’s a big mistake. The point in earning money is to be able to spend it on the experiences that make your life what it is.

We get money so we can have experiences. Your life is the sum of your life experiences.

Use your money to invest in experiences. Experiences yield dividends because humans have memory. Every time you access that memory, you unlock something called memory dividends.

What are you saving for? Be specific.

Just to have it? In case something bad happens?

When are you going to spend that money you’re saving? Retirement is not an optimal time to start spending that money.

Traditionally, people increase their net worth until they stop working, and then become afraid or unable to even enjoy it.

“People are more afraid of running out of money than wasting their life. Your biggest fear ought to be wasting your life and time, not ‘Am I going to have X number of dollars when I’m 80?’”

You should be asking yourself, “How do I make the most of my finite time on Earth?”

Each season of your life has varying amounts of 3 precious resources – Health, Wealth and Time.

- When you’re young, you have health and time, but little wealth.

- When you’re 30-50, you have health and and wealth, but little time.

- When you’re 60-80, you have wealth and time, but poor health.

Be realistic and plan what experiences you’re going to have and when.

- When you’re young, create experiences that require health and time (backpacking, traveling, sleeping on floors, etc).

- When you’re middle aged, you’re in a time crunch so use your money to get back time for meaningful experiences (get house cleaned, laundry, lawn care, etc).

- When you’re old, you won’t be able to do crazy adventures (unless you take amazing care of your body now) so plan experiences that don’t require much health.

Putting off life for retirement is dumb.

By the time you retire, your health will have declined putting significant limitations on what experiences you can have.

You can control how much time at each age you devote to earning money versus having enjoyable experiences.

To get the most out of your time and money, timing matters. We all need to time our experiences properly.

Plan how you will spend your time and money to achieve the biggest peaks you can with the resources you have — is how you maximize your life. By taking charge of these crucial decisions, you take charge of your life.

To make the most of your hard-earned money, you must crack open your nest egg at a deliberately-planned time to end with zero.

Don’t sacrifice your life for money. Use your money as a tool to maximize your life.

Great quotes from Die With Zero book

“Delaying gratification at the extreme end means no gratification.”

“The business of life is the acquisition of memories. In the end that’s all there is.”

“One of the biggest factors you control is how much time at each age you devote to earning money versus having enjoyable experiences.“

“Material objects can be replaced but memories are priceless.”

“People are more afraid of running out of money than wasting their life. Your biggest fear ought to be wasting your life and time, not ‘Am I going to have X number of dollars when I’m 80?’”

Highly recommend reading this book. It will change your perspective and hopefully knock you off living on autopilot.

For more info on the book visit, Die With Zero here.

Share

Show

5 comments